16 tips for Smart Finance to Secure Your Future

Fitness and health are important, and I’ve also realized that being financially strong matters just as much. So, I’m sharing some simple financial knowledge.

These days many people struggle to build a good life. A lot of people work hard and earn money, but still can’t become financially strong. That’s why I want to share some basic financial lessons — these aren’t just for businessmen or investors; they’re important for everyone. Whether you’re a student, a working professional, or managing a home, if you know how to earn, save, and grow your money, you can live a financially secure life.

Finance isn’t just about money — it’s about using that money in the right way.

So let’s start — step by step — with the most important financial ideas everyone should know.

We can learn

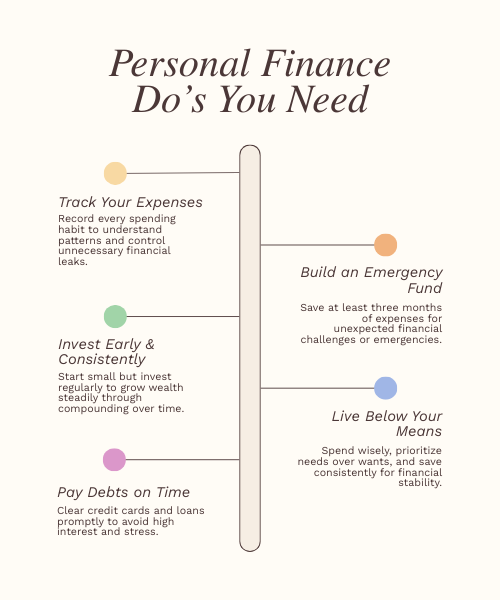

1. Understand the Basics of Personal Finance

Personal finance simply means planning and managing your own money wisely.

It has five main pillars:

- Income – The money you earn from your job, business, or freelancing.

- Expenses – The money you spend on daily needs, rent, EMIs, and lifestyle.

- Savings– The portion you keep aside for emergencies and future goals.

- Investments – The money you put into assets to help your wealth grow.

- Protection – Insurance and risk management to secure your financial health.

If you understand and control these five pillars, your financial foundation becomes strong and stable.

learn to end (16 tips for Smart Finance to Secure Your Future)

if you want learn fitness knowledge then 👇👇

2. Importance of Financial Planning

“Failing to plan is planning to fail.”

This quote fits perfectly when it comes to finance.

Financial planning is like a roadmap that helps you decide:

- How much you want to earn

- How much you should spend

- Where you should invest

- And how to plan for your future goals — like buying a home, a car, or preparing for retirement

You can follow a simple 50/30/20 rule for balance:

- 50% → Needs (bills, rent, food)

- 30% → Wants (travel, shopping, entertainment)

- 20% → Savings & Investments

This rule helps you maintain a healthy financial balance every month.

3. Control Your Expenses (Budgeting Skills)

No matter how much you earn, financial knowledge only works when you control your spending.

In today’s digital world, impulsive spending has become common — online shopping, subscriptions, and lifestyle temptations make saving harder.

Smart ways to manage expenses:

- Create a monthly budget sheet (using Google Sheets or a finance app)

- Write down every expense — small or big, everything counts

- Separate your “Needs” and “Wants” clearly

- Prefer cash payments instead of digital ones — it gives psychological control over spending

Always remember:

“It’s not how much you earn — it’s how much you save that builds real wealth.”

Saving is the foundation of wealth.

Even if you save a small amount every month, it can grow into a huge sum over time — thanks to the power of compound interest.

For example:

If you invest ₹5,000 (about $60 USD) every month at a 10% annual return,

in 20 years it can grow to around ₹38 lakh (≈ $45,600 USD).

That’s the magic of consistent saving!

So, start early — because “small savings build big wealth.”

Smart saving ideas:

- Set up an automatic SIP (Systematic Investment Plan) in mutual funds

- Use Recurring Deposits (RDs) for disciplined saving

- Avoid unnecessary EMIs or luxury loans

- Maintain an emergency fund covering 3–6 months of expenses

A strong saving habit gives you both financial security and peace of mind.

16 tips for Smart Finance to Secure Your Future

📈 5. Start Investing Early

The purpose of investing is simple — to grow your money.

Saving alone isn’t enough because inflation slowly reduces the value of money.

That’s why investing is essential to build long-term wealth.

Here are some popular investment options:

- Mutual Funds – Best for beginners; professionally managed portfolios.

- Stock Market – High risk but potentially high returns (research before investing).

- Fixed Deposit (FD) – Safe option, though returns are lower.

- Gold or Silver – Acts as protection against inflation.

- Real Estate – Ideal for long-term wealth creation.

- Crypto (optional) – Highly volatile; invest carefully and in small amounts only.

And always remember the golden rule:

“Don’t work for money — make your money work for you.”

Start early, stay consistent, and let time multiply your wealth.

6. Build an Emergency Fund

Life is unpredictable — things like job loss, medical emergencies, or family problems can happen anytime.

In such situations, instead of taking loans or borrowing money, having an emergency fund makes life much easier.

Ideal amount:

Keep at least 3 to 6 months’ worth of your monthly expenses saved as an emergency fund. Use a separate savings account for this money so that you don’t end up spending it unnecessarily.

This small habit can protect you from big financial stress in the future

7. Insurance – Financial Protection

Insurance may sound boring to many people, but it’s actually the backbone of financial security.

It’s not just about paying premiums — it’s about protecting yourself and your family from unexpected losses.

Important types of insurance:

- Health Insurance – Protects you during medical emergencies

- Term Insurance – Provides life cover and secures your family financially

- Vehicle Insurance – For legal protection and road safety

- Home Insurance – Protects your property from natural disasters or accidents

Taking insurance isn’t wasting money — it’s investing in peace of mind.

8. Avoid Bad Debt

Credit cards and personal loans may look attractive, but using them the wrong way can lead to serious financial stress.

Good debt can help you grow — bad debt can pull you down.

Examples:

- Good debt: Home loan, education loan (these build long-term value)

- Bad debt: Credit card bills, personal loans for shopping or luxury EMIs

Tips to stay safe:

- Always pay your credit card bill in full and on time

- Never fall into the “minimum payment” trap

- Compare interest rates before taking any loan

- And most importantly — never borrow for luxury or show-off spending

Would you like me to continue the next section — “9. Learn About Tax Planning” — in this same smooth, global English tone?

Good debt: Home loan, education loan

Bad debt: Credit card bill, personal loan for shopping, lifestyle EMI

Tips:

- Always pay full credit card bill on time

- Avoid “minimum payment” trap

- Compare interest rates before taking any loan

- Never borrow for luxury

9. Learn About Tax Planning

Smart people always save tax legally — through proper knowledge and planning.

Here are some best tax-saving investment options (India specific) under Section 80C:

- ELSS Mutual Funds – Equity-Linked Savings Schemes with good returns

- PPF (Public Provident Fund) – Safe long-term savings option

- NPS (National Pension Scheme) – Ideal for retirement planning

- LIC Policy – Traditional life insurance savings plan

- 5-Year Fixed Deposit (FD) – Safe and simple tax-saving investment

With the right tax knowledge, your net income automatically increases —

you earn the same, but you keep more of what you earn.

10. The Magic of Compound Interest

Compound interest is truly a magical concept — the power of “interest on interest.”

This is how your money quietly grows over time without any extra effort.

Example:

If you invest ₹10,000 at 10% annual return,

after 1 year it becomes ₹11,000.

In the next year, interest is earned on ₹11,000, not ₹10,000 —

and this process keeps repeating.

That’s why starting early is the most powerful step in wealth creation.

Time + Consistency = Financial Freedom.

💡 Real-life example: Land & Mushroom Farming

If you already own land, that’s a big asset. In today’s world, agriculture and organic farming are becoming more valuable again.

For instance, Mushroom Farming is a highly profitable small-scale business idea.

Even on a small plot, you can grow mushrooms using straw and spawn within just 2–3 months.

Maintain proper temperature (20–30°C), humidity, and clean environment,

and you can sell your harvest to local markets, restaurants, or even online platforms —

earning around ₹1–1.5 lakh profit per cycle.

So whether you invest in financial assets or natural assets like land —

the key is to make your money grow for you.

11. Learn the Difference Between Assets & Liabilities

One of the smartest money lessons ever:

“Rich people buy assets. Poor people buy liabilities.”

Understanding this difference changes your entire financial mindset.

Assets are things that generate income for you:

- Stocks & mutual funds

- Real estate or farmland

- Businesses or side hustles

- Intellectual property (like books, online courses, or digital assets)

Liabilities are things that drain your income:

- EMI-based gadgets

- Luxury cars (that lose value over time)

- Personal loans or credit card debt

Before buying anything, ask yourself:

That one simple question can save you from years of financial stress.

12. Develop Multiple Income Streams

Depending on a single income source is risky in today’s world.

During job loss, illness, or market changes, life can become financially difficult.

💡 Extra Income Ideas:

- Freelancing

- Blogging or YouTube

- Online teaching or coaching

- Investing in mutual funds or stocks

- Creating digital products

👉 Having multiple income sources means greater financial stability and security for your future.

13. Don’t Depend on a Single Income Source

Relying on just one income source is very risky in today’s world.

Job loss, illness, or sudden market changes can easily create financial stress if you have only one way to earn money.

That’s why building multiple income streams is essential for long-term security.

Extra Income Ideas:

- Freelancing (writing, graphic design, digital marketing)

- Starting a blog or YouTube channel

- Online teaching or coaching

- Investing in mutual funds or stocks

- Creating digital products (eBooks, online courses, templates)

14. Improve Your Financial Literacy Daily

Financial education never ends.

Every year, market trends, tax laws, and investment options keep changing — that’s why continuous learning is essential.

Best Ways to Learn About Finance:

- Read books like Rich Dad Poor Dad and The Psychology of Money

- Watch finance creators on YouTube (e.g. Nischay Malhan, Pranjal Kamra)

- Use investing apps such as Grow, Zerodha, or Kuvera

- Take short online courses on financial planning and investing

- Follow finance-related news, blogs, and podcasts regularly

“Knowledge = Control over your money.”

The more you learn, the smarter your financial decisions become.

15. Retirement Planning – Think Long Term

Many young people avoid thinking about retirement — but that’s one of the biggest financial mistakes.

If you start planning early, even small investments can grow into a huge amount over time.

Example:

If you invest ₹5,000 per month in a SIP with a 12% annual return,

you can build around ₹1.7 crore (≈ $204,000) in 30 years!

Retirement is a long-term goal, and the earlier you start, the better your results will be.

Invest a little today so you can live a stress-free and financially secure life tomorrow.

16. Teach Financial Skills to Your Family

Financial knowledge becomes truly valuable when you share it with your family and kids.

Teach your children the basics of saving, budgeting, and smart spending from an early age.

When the whole family is financially aware, it brings long-term peace and security.

If every household starts practicing financial education,

our entire society becomes stronger and more stable.

Final Conclusion

Money isn’t everything — but financial freedom truly is.

When you have control over your money, your stress decreases and your happiness increases.

The best financial wisdom is simple:

Earn smart. Spend wisely. Save consistently. Invest early. Stay insured.

Life becomes peaceful when your money works for you — not when you keep working for money.